Every income received is required to declare tax in Malaysia, including those income received from foreign country. Yet, it is hard to determined which income is taxable under foreign sourced income and how would it be taxed.

In this article, we will share about the FSI and how to determine if you need to declare FSI.

Generally, an income is consider as foreign sourced income and taxable when:

If the result shows ‘taxable’ on the above, then you need to go through the following simple test.

This is a simple self test that we designed based on GENERAL individual situation. If you have any special situation, kindly seek assistance from your tax agent.

FAQs:

Malaysian tax residents who received any types of income from overseas is considered as FSI. FSI which brought into Malaysia is taxable since 2022.

FSI includes:

- Business income

- Employment income

- Dividends, interest or discounts

- Rent, royalty or premium

- Pension, annuity or periodic payments

- Other income other than above

When the Foreign Sourced Income (FSI) is remitted / brought in / transferred to Malaysia physically or through banking methods.

Malaysia Tax Resident (For those who stays in Malaysia for more than 182 days.)

The government has exempted the followed FSI until 2026:

- All types of income received by individual other than partnership, if

- The income has been subjected to tax in the country of origin

- Dividend income received by Company, LLP or partners if:

- The dividend income has been subjected to tax in the country of origin

- The highest tax rate (headline tax) in the country of origin is not less than 15%

Foreign Sourced Income (FSI) will be taxed based on your personal tax rate. However, if your FSI is remitted into Malaysia on or before 30.06.2022, you are eligible for a special tax rate of 3%.

| FSI Remittance Period | Tax Rate |

|---|---|

| 01.01.2022 – 30.06.2022 | 3% |

| After 01.07.2022 | Based on Personal Tax Rate |

It is a special plan introduced by LHDN to let tax resident who have foreign sourced income to enjoy lowest tax rate at 3% for the income they brought into Malaysia.

01.01.2022 – 30.06.2022

All Malaysia taxpayers are eligible, including individual, company, LLP, cooperatives, trust bodies, business trusts, associations and so on.

Income kept abroad remitted to Malaysia by a resident whether business income, employment salary, dividends, rent, interest, royalties or others.

*Including income from year of assessment 2020 and previous year of assessment which not yet reported.

10. If this income has been declared in foreign tax, is it eligible to claim a tax credit deduction?

Yes, taxpayers applied for this deduction have to keep the documents as a proof.

Form BE:

- If your FSI is exempted by the government, fill in the details in Part K.

- If your FSI is taxable and:

- Remitted to Malaysia between 01.01.2023 – 30.06.2023: Fill in the details in Part B14

- Remitted to Malaysia after 01.07.2023: Fill in the details in Part B4 & Part E

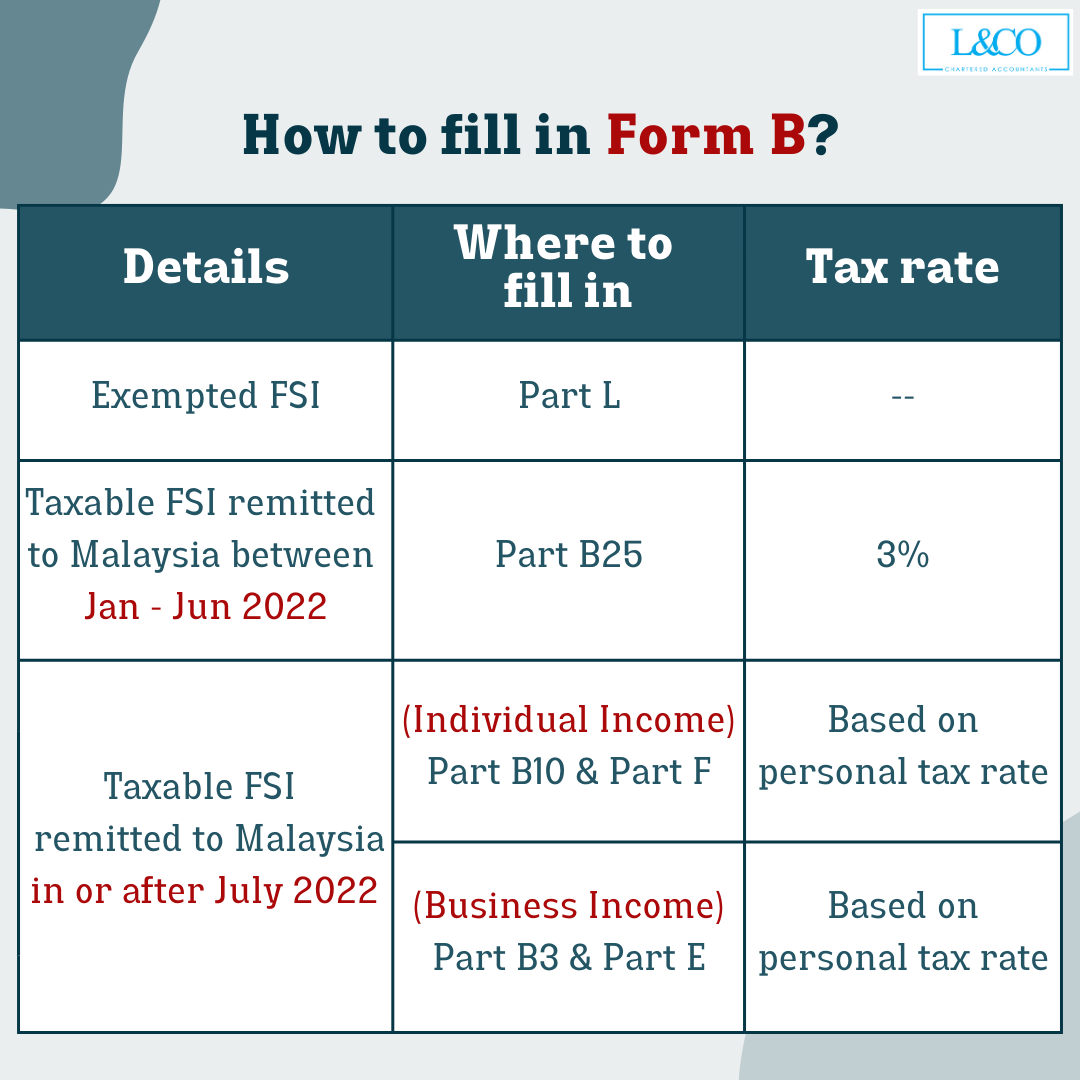

Form B:

- If your FSI is exempted by the government, fill in the details in Part L.

- If your FSI is taxable and:

- Remitted to Malaysia between 01.01.2023 – 30.06.2023: Fill in the details in Part B25

- [Individual Income] Remitted to Malaysia after 01.07.2023: Fill in the details in Part B10 & Part F

- [Business/Partnership Income] Remitted to Malaysia after 01.07.2023: Fill in the details in Part B3 & Part E

(201706002678 & AF 002133)

(201706002678 & AF 002133)