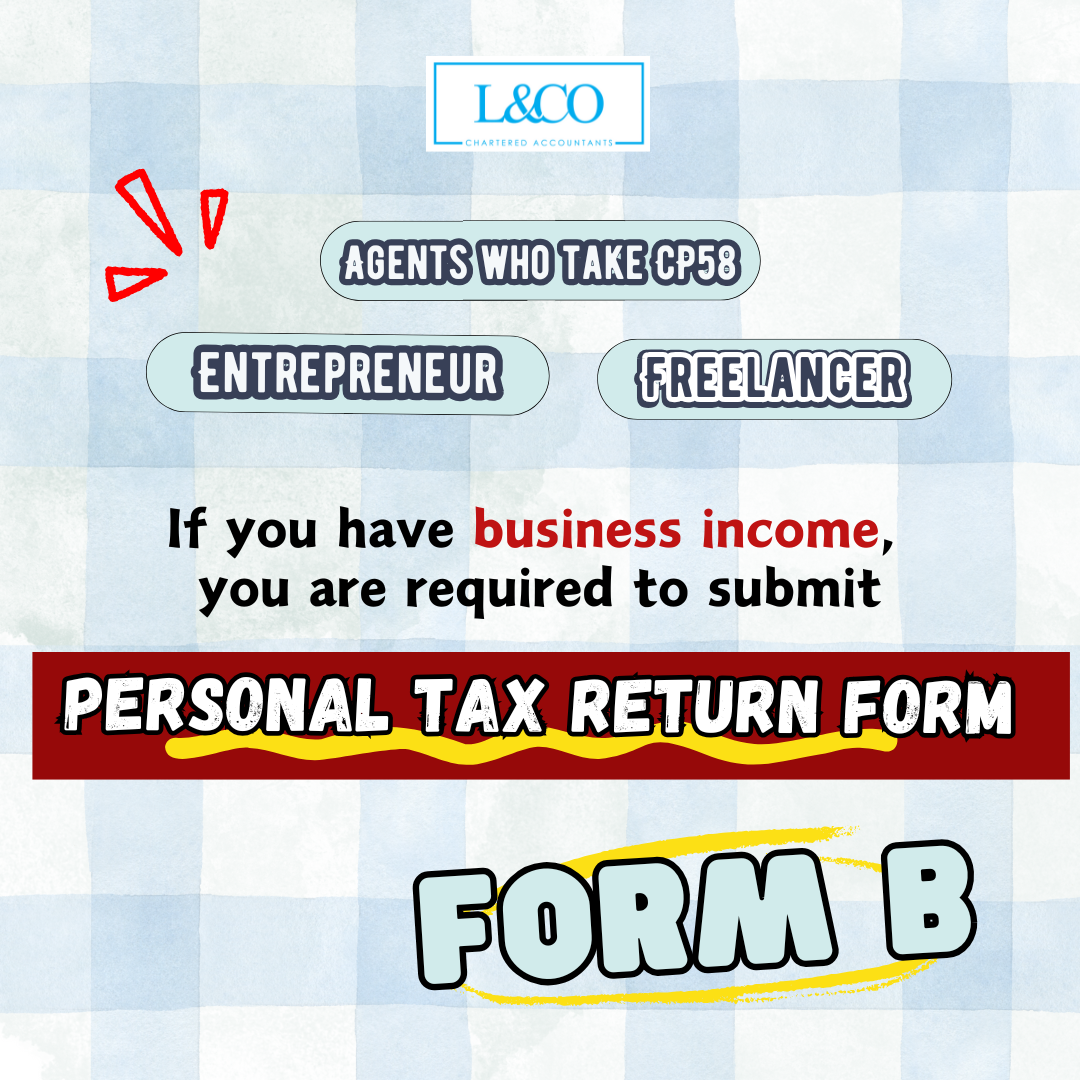

It is time to submit Form B! For individuals with business income (income other than employment income), you will need to file the Form B.

FAQs about Form B:

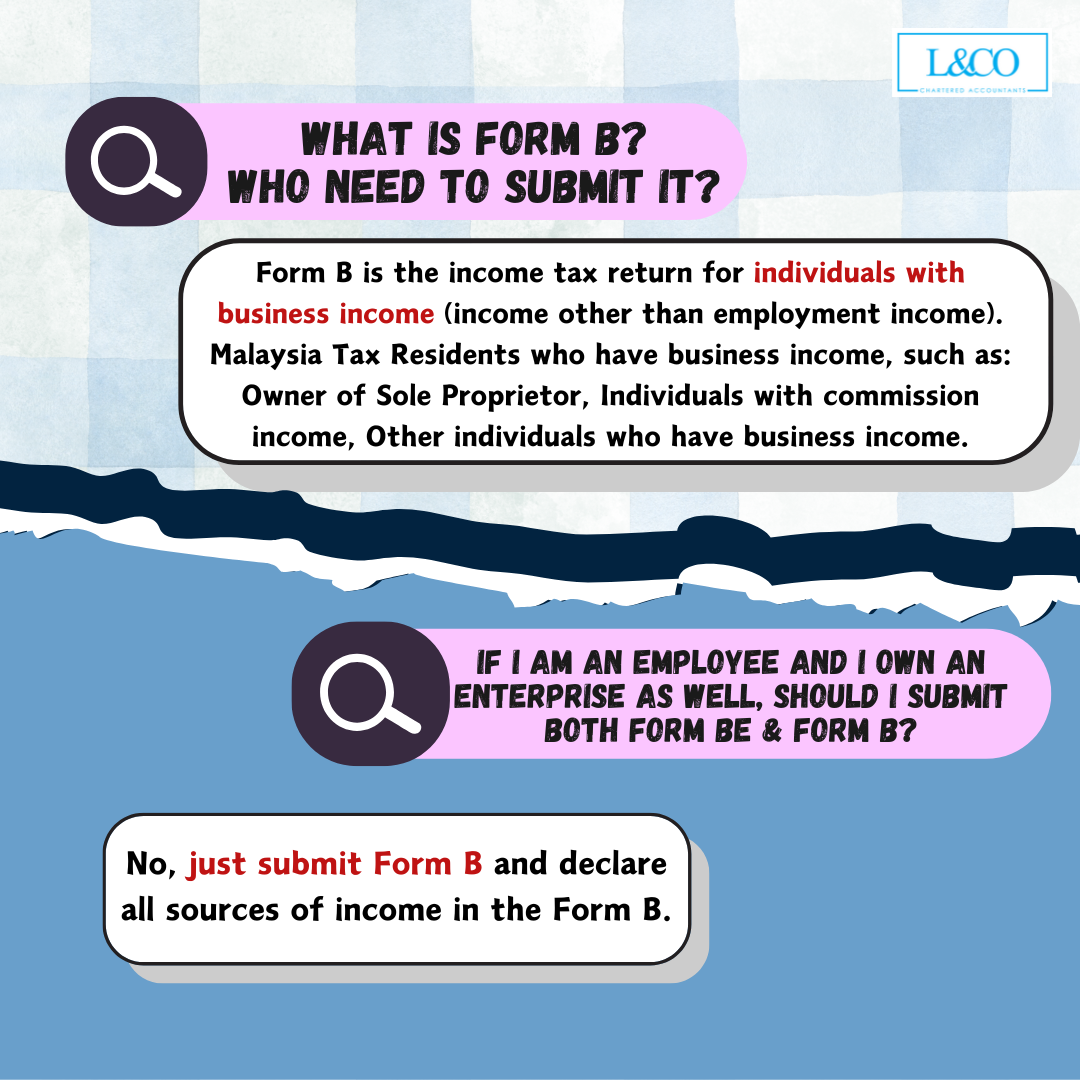

Form B is the income tax return for individuals with business income (income other than employment income). Malaysia Tax Residents who have business income, such as: Owner of Sole Proprietor, Individuals with commission income, Other individuals who have business income.

No, just submit Form B and declare all sources of income in the Form B.

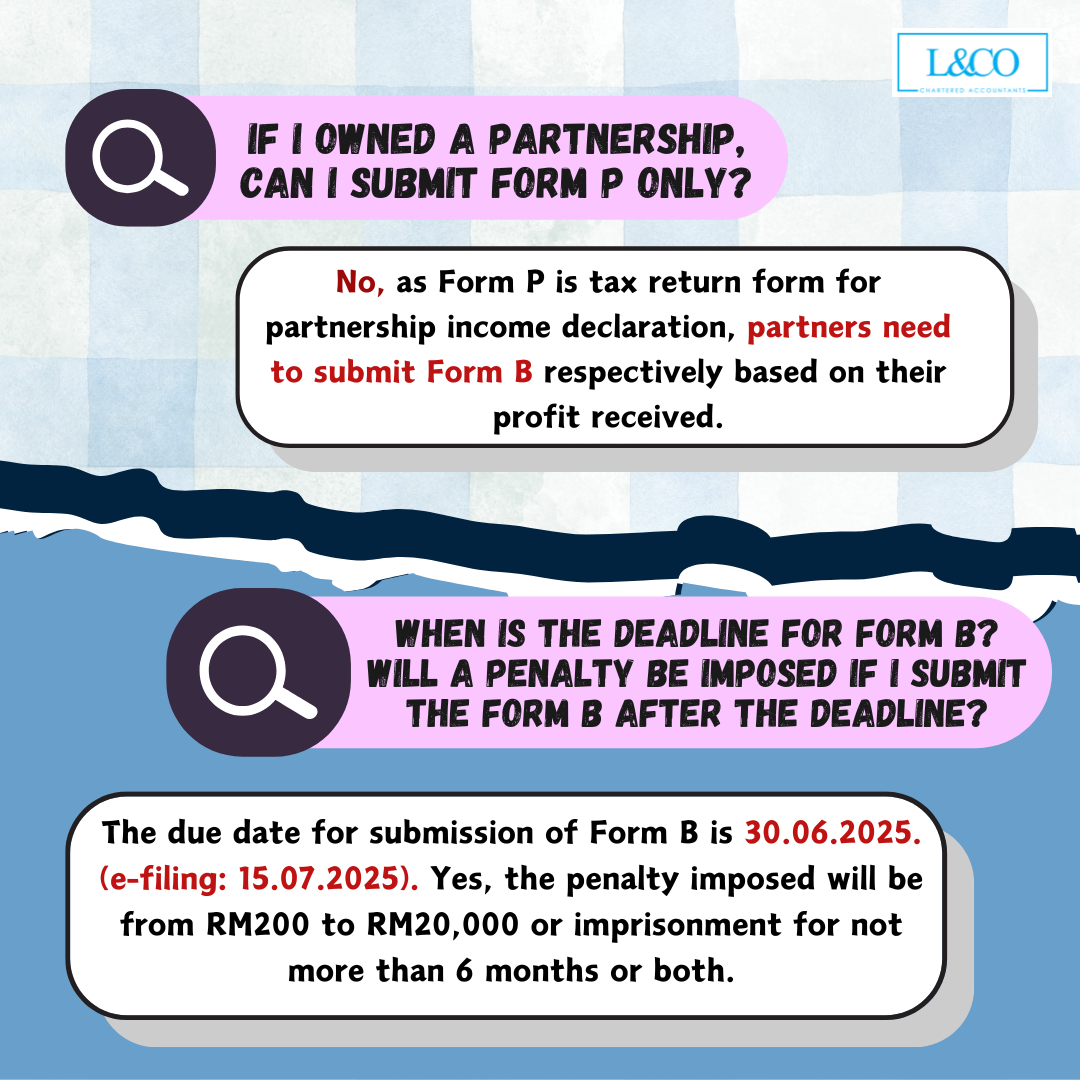

No, as Form P is tax return form for partnership income declaration, partners need to submit Form B respectively based on their profit received.

The due date for submission of Form B is 30.06.2024. (e-filing: 15.07.2024). Yes, the penalty imposed will be from RM200 to RM20,000 or imprisonment for not more than 6 months or both.

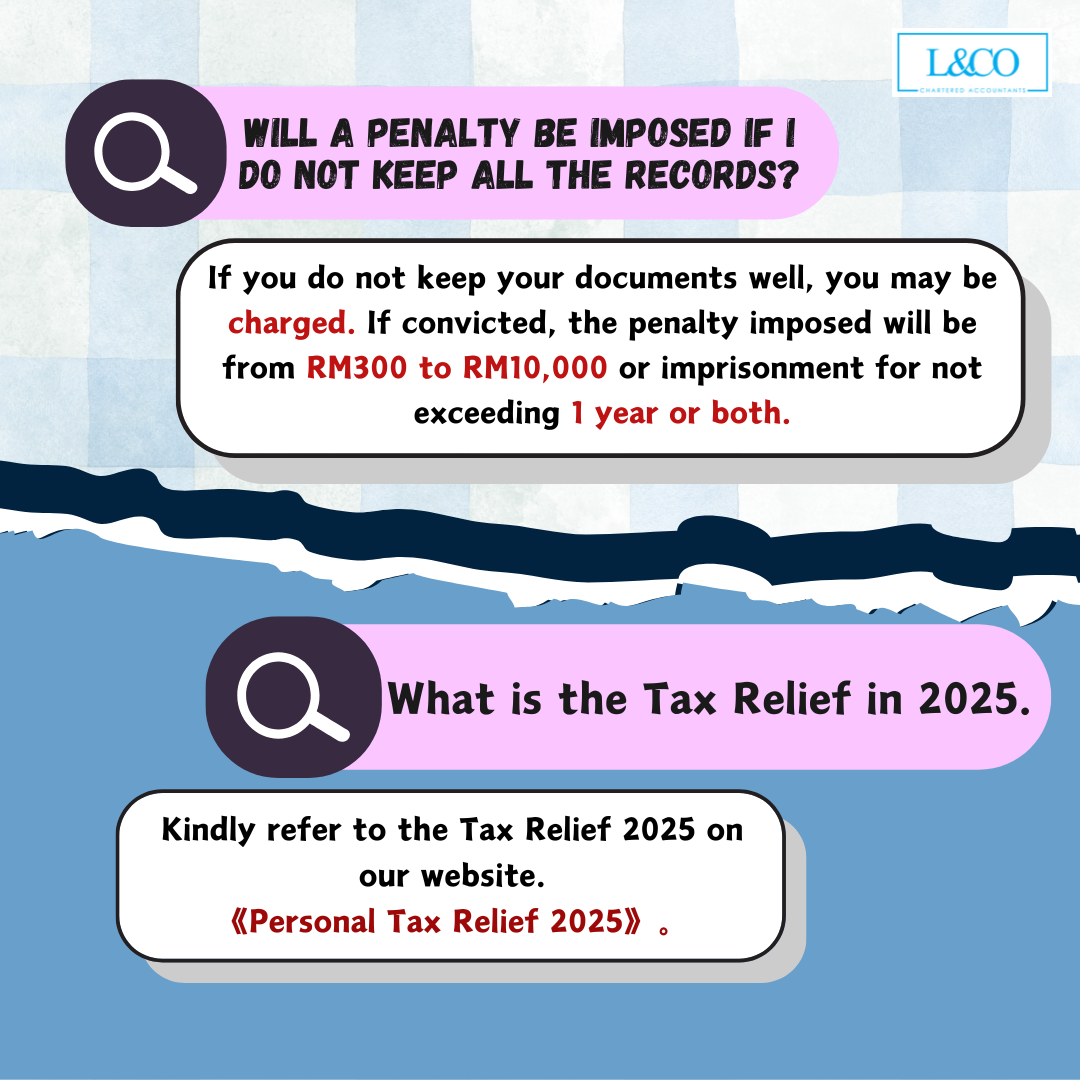

If you do not keep your documents well, you may be charged. If convicted, the penalty imposed will be from RM300 to RM10,000 or imprisonment for not exceeding 1 year or both.

Kindly refer to the Tax Relief 2025 on our website.

Personal Tax Relief: https://landco.my/tax-relief-en/personal-tax-relief-2025/

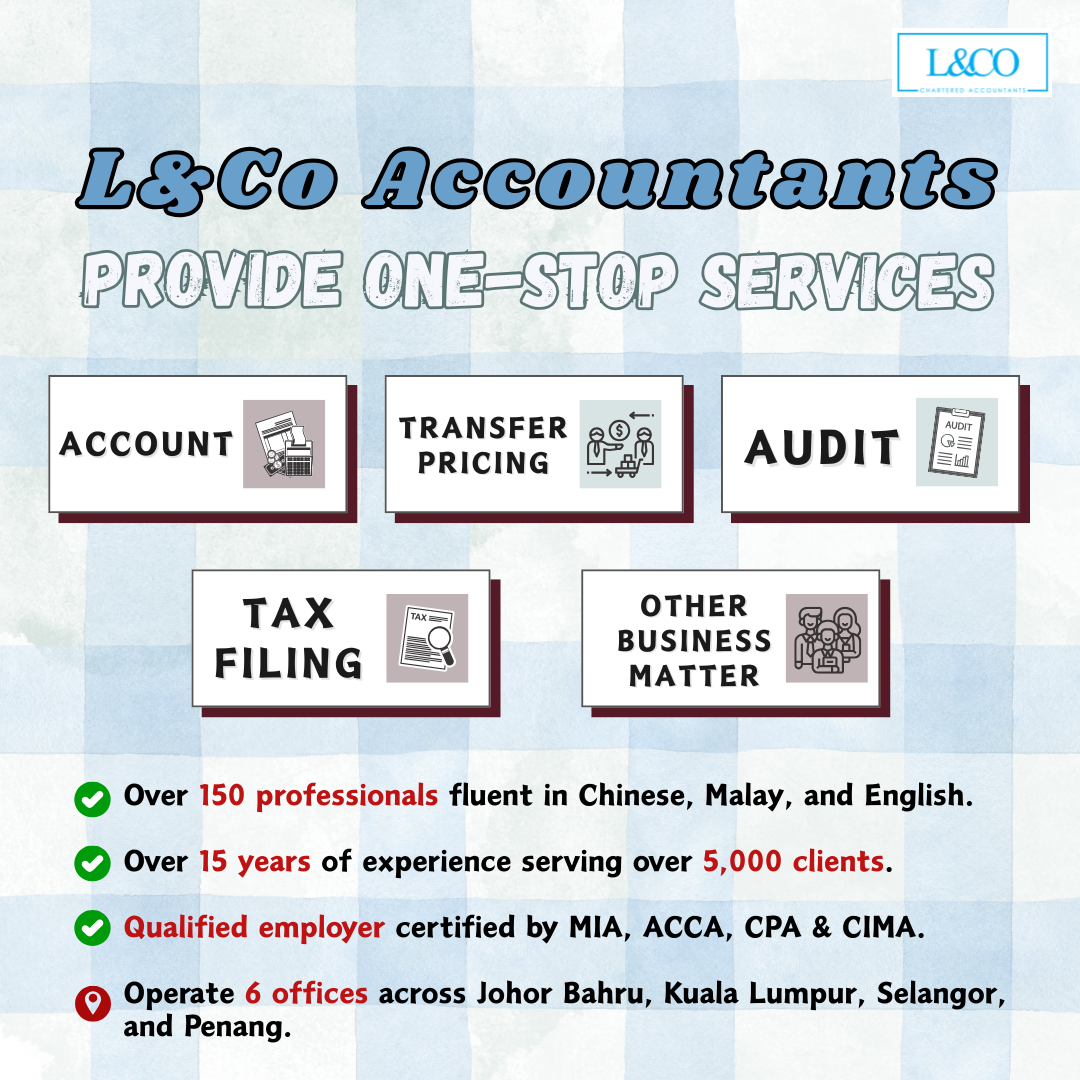

(201706002678 & AF 002133)

(201706002678 & AF 002133)